Loading...

Indicators

Price/Heikin-Ashi

The Japanese Heikin-Ashi method (balance legs) is a different view of candles. Created in 1700 by Munehisa Homma, author of the candlestick chart. Heikin-Ashi take into account the average price traded in the period and not just the opening and closing prices. This way it is possible to better visualize a trend or a consolidation movement.

The Expert makes use of the iPrice indicator to have both conventional candlestick price values and keikin-ashi prices available.

All indicators present their values in the data window and the description is presented in a way that will simplify the user to understand how to use these values within the EA.

Fibonacci Regression/Projection

Donchian Channel

Double Bollinger Bands

Keltner Channel

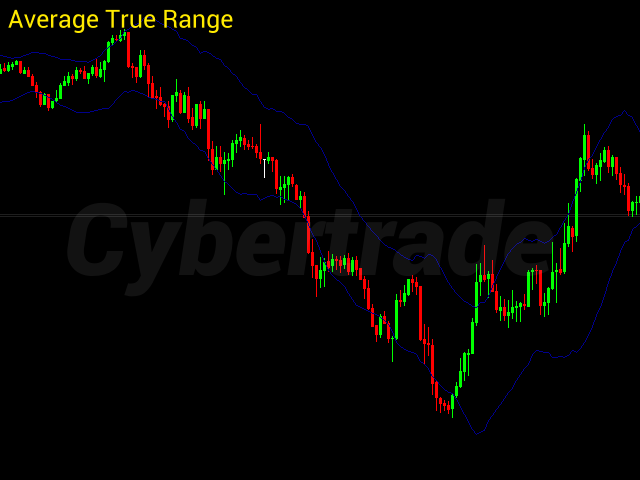

Average True Range Channel ATR

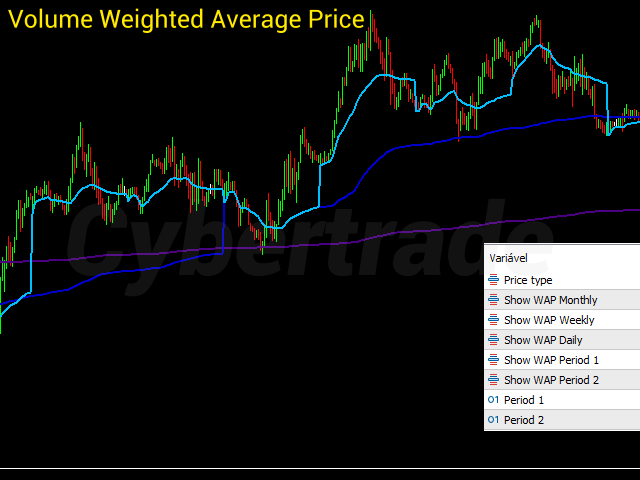

Volume Weighted Average Price VWAP

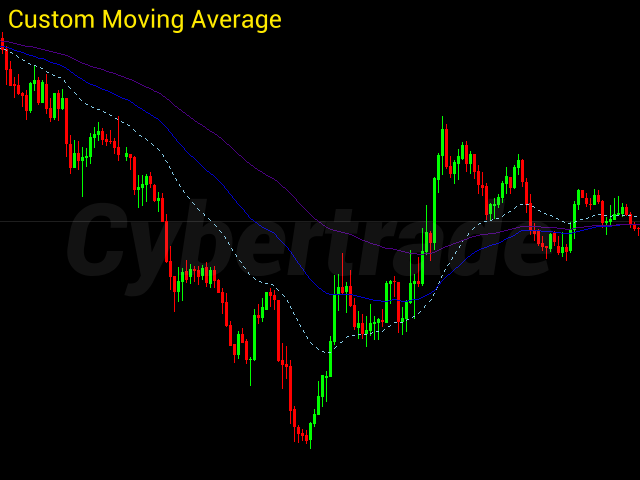

Custom Moving Averade

Kaufman Adaptive Moving Average

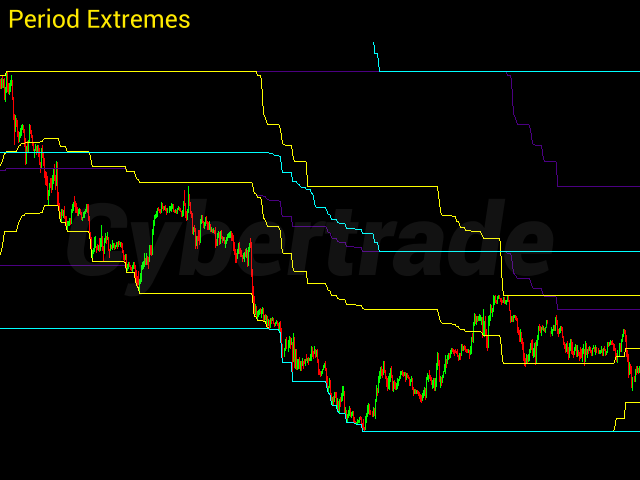

Extremes

ZigZag

Parabilic SAR

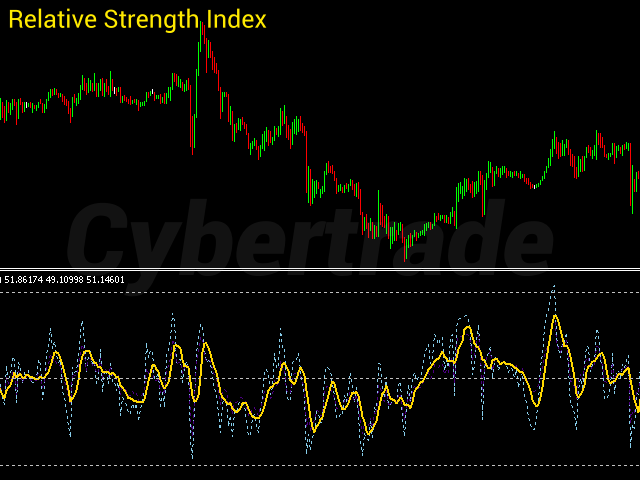

Relative Strength Index

Stochastic

Moving Average Convergence/Divergence

Volume